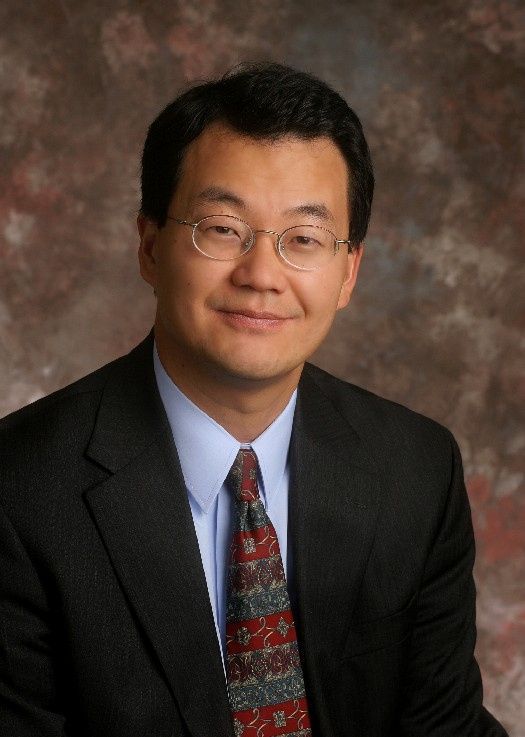

Enough about me… what’s happening in the real estate market?

Despite the economic fluctuations across America, the Bozeman real estate market has shown remarkable resilience in the first half of 2024. Even with residential purchase interest rates at 7%, Bozeman’s asking prices have surged by 26% since the peak of our market in 2021 and 8% since 2023. Bozeman continues to outshine the national market, which has remained stable, neither growing nor softening between 2023-2024. While the national market was at a standstill, Bozeman’s values rose by 8%. This is a testament to the enduring appeal of Bozeman, where buyers are still eager to invest, and we continue to grapple with a housing shortage.

Builders have continued to benefit from our constrained market, with 2023 being the Homebuilders' third-best year of performance since the 2008 foreclosure crisis. The 2020-2021 buyer interest rates created limited resale inventory, causing builder products to be the majority of what was available in 2023, nationally. Locally, nothing was really new there; we always have a housing shortage… making this a great community to be a builder!

There is currently 4 months of inventory in our Bozeman market. This marked an improvement for Buyers from 2021, where we averaged a one-month supply. The inventory increases means buyers finally have a chance to think and make an informed decision in their purchase, as opposed to 2021, which was characterized by a “buy now, decide if you want it later” mentality. But don’t be confused. This increase in inventory hasn’t shifted Bozeman into a Buyer's market; there isn’t a huge window to negotiate. Asking price vs. sold price negotiations are still hovering in a 4% window. Furthermore, well-priced homes continue moving quickly, with properties staying on the market for a median of 3-4 days through May 2024.

As we move into June, our median days on the market have jumped to 40+ days. This is a new outlier and will be a curious trend to track as we have just made it through graduation season, school ending, and are transitioning into our historically busiest time of the year. While this is an election cycle, and those always impact the market activity, I anticipate this brief pause in our market lifting this month, and we will be back to business as usual until the end of September when everyone starts holding their breath again.